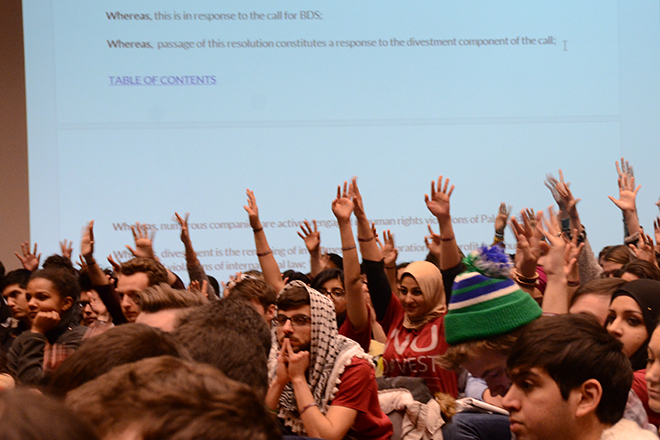

When NU Divest’s resolution narrowly passed ASG last February, few details were publicly available about Northwestern’s financial investments in Caterpillar, G4S, Lockheed Martin, Hewlett-Packard, Boeing and Elbit Systems. The divestment campaign specifically mentioned the six corporations due to their alleged human rights violations in Palestine.

In a recent interview, Northwestern's Chief Investment Officer William McLean said the University holds direct investments in two of the companies listed in the resolution, although he declined to name the specific companies.

“We have positions in two of them,” he told NBN, saying that he has given the information to students working on the divestment campaign. “I’ve been upfront about that, it’s a small amount of money. The larger issue is not which companies but the fact that we have two. They know we have them, and that’s the issue,” McLean said.

However, a few hours after the resolution was officially passed by ASG in the early morning of Feb. 19, 2015, Northwestern released a statement saying that the University “does not directly hold shares in any of the six companies, nor does it generally hold stocks in individual firms.”

In the months following the resolution, members of the divestment campaign have been meeting with McLean regarding specifics about the next steps. In an email provided to NBN by NU Divest, McLean told the students last December that Northwestern in fact owns close to $3 million in equities in G4S and Caterpillar.

Some of Northwestern’s assets are managed by hedge funds, which are not themselves transparent with the University about their holdings. The Investment Office has little control over which companies’ stocks are purchased or sold. McLean said it was likely that the hedge funds are invested in the other four companies highlighted by the NU Divest resolution.

However, the University also holds separately managed accounts that are held in the University’s name. “With those accounts, we do have the ability to say, ‘Divest that stock or don’t,'” McLean said.

Although $3 million represents a small portion of Northwestern’s roughly $10 billion portfolio, it might represent a more tangible and immediate goal for the students working towards divestment.

“This will help us be a lot more focused in our campaigning in the future,” said Ruba Assaf, a Weinberg junior involved with the campaign. “Moving forward, all of our material will probably focus on G4S and Caterpillar.”

Assaf declined to provide full details, but indicated that an announcement about the recent news would be made at an event planned for Monday, Jan. 11. “ We know that the total ownership in these two companies is a small amount, so divestment, as ever, remains a symbolic gesture but we do plan on continuing to call for divestment from these companies,” she said.

The Investment Office’s lack of transparency, even given its constraints working with hedge funds, has also highlighted the need for a transparency task force called for by the original resolution. “After realizing how hard students have to work to access basic information, we’ve doubled our efforts working for the task force. At the core of our belief is that students should be able to have free access to this information,” Assaf said.

McLean said he wasn’t sure “what [students] would do about it” if they had full access to information about the University’s holdings and hedge funds. Money managers do not typically want information about their investments made public by universities, since that information would then be easily available to the press, McLean said. He cited the example of a public university that was fired by a money manager when it took steps towards greater transparency. McLean asked that the public university remain unnamed because Northwestern works with the same money manager.

“It’s more about protecting Northwestern’s ability to invest with people than it is to hide from students,” McLean said about NU's lack of transparency.

That argument hasn’t deterred NU Divest from working towards greater transparency alongside its calls for divestment. “If you can’t be transparent without facing issues, you’re probably doing something wrong,” Assaf said. “These schools, it’s in their best interest to start moving towards socially responsible investing and socially responsible hedge funds.”